The South East Caucus in the Senate has joined other stakeholders in the polity to call for broader consultations on the Tax Reform Bills currently pending consideration and possible passage by the National Assembly.

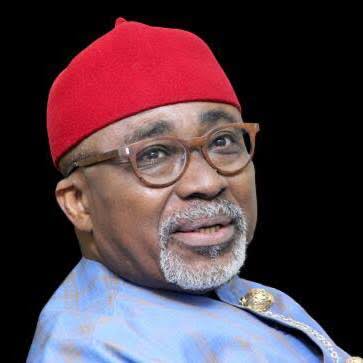

Leader of the Caucus, Senator Enyinnaya Abaribe (APGA, Abia South), made this known today during a press briefing after a closed-door meeting with senators from the five South Eastern states held in his office.

Abaribe underpinned that the South East senators are not opposed to the bills but are advocating for extensive consultations with their constituents and key stakeholders before a final decision is made in both chambers of the National Assembly.

“While we are not against the Tax Reform Bills currently before both chambers of the National Assembly, we believe wider consultations must be carried out,” Abaribe stated.

He further highlighted the need to engage with constituents across the 15 senatorial districts in the Southeast zone, as well as state governments and other critical stakeholders.

He stated “We have carefully reviewed the bills and feel it is essential to share our insights with stakeholders in the South East to ensure a more equitable framework in the eventual legislation. This is about ensuring that the bills serve all Nigerians fairly, particularly our region,” Abaribe added.

The Tax Reform Bills under consideration include the Nigeria Tax Bill 2024, the Nigeria Tax Administration Bill 2024, the Joint Revenue Board of Nigeria (Establishment) Bill 2024, and the Nigeria Revenue Service (Establishment) Bill 2024. These bills, submitted to the National Assembly by President Bola Tinubu on October 3, 2024, have sparked widespread debate across the country.

While the presidency and the South-South Caucus in the Senate have called for the bills’ swift consideration, other groups, such as the Nigerian Governors’ Forum, the Northern Senators’ Forum, and the Arewa Consultative Forum, have echoed the South East Caucus’ demand for wider consultations.